Should You Buy Or Build? A Guide On House Costs In The Philippines

by Silingan

Feb 06, 2023

Picking a home to begin your new life is an incredible milestone that should be taken seriously. Whether you build or buy one, there are several factors and choices at hand which must be carefully examined before signing any contracts or handing over the money.

Above all else, the most important decision lies in whether it would make more sense to construct your own dream abode from scratch or purchase an already-made property. Investing time and effort into deliberating these two alternatives can result in making a wise investment of both finances and future happiness.

Before we begin with the breakdown of the cost of building a house in the Philippines vs. Purchasing an already-made one, let us first discuss the advantages of each option.

Cost Analysis – Building Your Own vs. Purchasing Ready-Made Houses

COST BREAKDOWN—BUILDING YOUR OWN HOUSE

A house is a long-term investment. That said, there are costs that you must consider before you begin construction. Considering these costs allows you to prepare the necessary budget for the construction of your house.

LAND ACQUISITION COSTS

Land acquisition costs refer to all expenditures to acquire the land and to ready it for use. This includes all the necessary costs in connection with the acquisition of the land, title fees, attorney fees, survey costs, and zoning fees. This may also include site preparation costs such as grading and draining or demolishing any property on the land.

MATERIALS AND LABOR COSTS

Material and Labor costs are common classifications of a manufacturing business based on the nature of the cost.

- Material costs refer to the cost of the materials used to construct your house. These typically include cement, bricks, sand, steel, tiles, etc.

- Labor costs, on the other hand, refer to the direct cost of hiring construction workers and other staff to complete a job. Labor costs include hiring excavators, masons, electricians, painters, and other construction personnel.

ARCHITECTURAL AND ENGINEERING FEES

Before you can actually construct, you need plans for the design and structure of your business. Architectural fees refer to the fees paid to people or entities that design buildings and structures. According to the guidelines by the United Architects in the Philippines, the cost for drawing a house plan is:

- 10% of the total projected costs of the construction if you require detailed Architectural and Engineering Design Services (DAEDS); or

- 6% of the total projected costs of construction if you just need Detailed Architectural Design Services.

MISCELLANEOUS OR ADDITIONAL EXPENSES

Besides the cost of construction and architectural fees, there are certain miscellaneous fees that you must consider in constructing a house, such as permits, survey costs etc. Here are seven miscellaneous expenses that you may incur in constructing a house.

BUILDING PERMIT

Before you can construct your building, you must acquire a building permit. This is to ensure that the proper technical, mechanical, and structural plans comply with the requirements set by the National Building Code of the Philippines.

SOIL TESTS

Soil tests determine how much the soil expands and contracts in response to variations in moisture content, which may influence the foundation of your home. You will then need to design your home’s foundations to ensure they can cope with the soil type.

CONTOUR SURVEY

A contour survey demonstrates the elevation, or height variations, of your land at different locations. Building on land is easier and less expensive the flatter it is. Sloping sites, while having fantastic views, might be more expensive to build on.

LANDSCAPING AND DRIVEWAYS

To completely comprehend what you're purchasing, read your building contract properly. It may surprise you when your finished home does not have the proper landscaping, paths, or even a driveway. These additions can quickly rack up costs.

MODIFICATIONS

Even modest adjustments to a builder's plans might cause the home's list price to skyrocket; this is especially true if they are significant structural improvements. The real hit in your pocket is when the plans are altered mid-way through construction, as this will entail additional costs on your part.

DELAYS

Delays can increase the cost of building your house. It occurs for variety of reasons, including delays with materials and bad weather. If you are renting while your new place is being built, this may not affect the price of your property, but it may influence your budget.

Cost Breakdown—Buying Ready-Made Houses

PURCHASE/CONTRACT PRICE OF THE UNIT/HOUSE

The purchase price refers to the actual price of the home as listed in the market or in your seller’s website. This typically includes the acquisition fees and all liens and mortgages on the property. Sellers often include purchasing price-related fees such as survey costs and other title-related fees.

STRUCTURE OF PAYMENT TERMS

Financing your real estate purchase may take on different structures depending on the agreement you have with your seller. These payment structures may be:

LUMP-SUM OR OUTRIGHT METHOD

According to the lump-sum method, an upfront payment covers the property's total purchase price. However, the contract sum must be paid within the period agreed upon by the parties. Sellers often give a discount to buyers who pay the purchase price outright.

FLEXIBLE PAYMENT SCHEMES

These refer to a payment method wherein the buyer has the right to operationally defer (delay) the payment of the amount due at a later date. This allows the buyer additional time to gather the funds to fulfill their financial obligations.

The deferred payment method does not usually give rise to interest. So, most buyers don’t want to be burdened with interest payments. Aside from saving on interest payments, this method also enables a shorter time period for the paperwork to be processed.

LONG-TERM FINANCING

Long-term financing means financing your purchase through a loan or a debt instrument. This is usually divided into two parts, namely: (a) Down payment; and (b) financed amount.

Long-term financing is generally sourced from term loans given by banks or other financing instructions. These term loans are payable for more than one year and are usually considered secured loans that are backed by collateral such as buildings, machinery, or other assets. Before your loan is approved, however, these financial institutions might require proof of income.

CASH INSTALLMENTS

Cash installment payment means you pay the purchase price through regularly scheduled payments. Paying through installments is beneficial since the payment is almost the same every time it is due. Hence, you can schedule your budget accordingly.

ADDITIONAL COSTS IN CONSTRUCTING A HOUSE

Aside from the house's purchase price, buying a house typically entails some miscellaneous expenses that you should be aware of so that you can plan and budget accordingly.

NOTARY FEE

This refers to the negotiated fee, which often amounts to 1-2% of the property's worth, that the buyer must pay to have the Deed of Absolute Sale notarized.

LOCAL TRANSFER TAX

Local Transfer Tax refers to the tax the buyer of any real property must pay when transferring ownership. The local transfer tax for provincial properties might cost roughly 0.50% of the property value.

REGISTRATION FEE

This registration fee, equivalent to about 1% of the selling price of the property, that the buyer must pay to the local Registry of Deeds where the house or property is located. This acts as a formal record of the ownership change.

MOVING-IN FEE

This is the price that the buyer must pay after making the property livable and before moving in. It may also cover association or subdivision dues and the connectivity of essential services.

DOCUMENTARY STAMP TAX

The documentary stamp tax refers to approximately 1.5% of the property's selling price or fair market value, whichever is larger, that the seller must pay for the documentation of the transaction.

CAPITAL GAINS TAX (CGT)

This is a reference to the tax that the seller must pay when selling real estate that is classified as a capital asset, such as a house. The CGT is 6% of the property's fair market value selling price, whichever is higher.

What Should You Consider Before Deciding?

Before ultimately deciding on whether to purchase a house or construct a new one, there are several crucial factors that you must take into consideration. These factors can help you decide the option which you find the most appealing.

LOCATION IS IMPORTANT

The location of your new home is a significant consideration you should consider. Factors such as:

- Proximity to thoroughfares, freeways, and highways;

- Potential employment opportunities in the area of your community;

- Availability of shopping malls, local markets, hospitals, churches, or other commercial buildings.

These factors must be kept in mind in deciding whether to construct a new home or merely purchase an already existing one. The availability of these locational landmarks makes your life a little bit easier because of their easy access.

YOUR BUDGET OR FINANCIAL CAPABILITY

While buying your own home may be considered a personal goal, you must take into consideration that you require an ample amount of money saved up to achieve this goal.

Budgeting not only allows you to plan for your long-term and short-term expenses, but it also ensures that you can control your money by keeping track of all your spending. Budgeting also helps you free-up funds to reach your homeownership goal.

ACCESSIBILITY AND AVAILABILITY OF AMENITIES

When deciding whether to purchase or construct a new home, the local amenities should always be considered. The tour or site visit should include not just the house or the lot but also any amenities and facilities that the neighborhood might provide.

Is there a suitable location for sizable gatherings? Does the neighborhood have recreational facilities for you or your kids to enjoy? Does the location have mini-parks for you to relax? These are among the questions that you should take into account before making your decision.

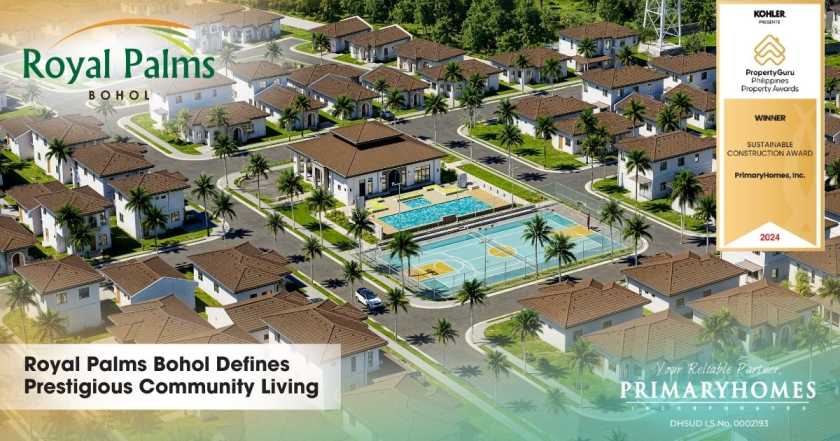

PrimaryHomes’ properties and community showcase a wide range of amenities that you and your family can enjoy.

CAN YOU CUSTOMIZE YOUR DREAM HOME?

Even your ideal home might require some personalization in the future. No matter how long you’ve dreamed of having a chef's kitchen, a backyard sanctuary with a pool, or a fancy media room, there is always that instance where these features will be precisely the way you want them. If in the future, you want to change some aspect of your home, the ability to do so without any significant changes to the structure of your system means that your home is customizable.

Thus, it is important that you consider this factor since if your home is not customizable, you will be forced to purchase a new one just to suit a layout or design you love.

PRESENCE OF AFTER-SALES MANAGEMENT OR MAINTENANCE

An after-sales service refers to the support given to you after you have purchased or constructed your home. These after-sales services aim to build a relationship of mutual trust to guarantee that the customer is satisfied.

These usually take the form of maintenance, repairs, incident tracking, and even updates on potential or existing projects. Before you decide to purchase or construct a house, ensure that the seller or the subdivision you are in offers after-sales services. This is to make sure that your life is hassle-free.

Building Your Own vs Buying Ready-Made Houses?

In deciding to build your own home or purchase an already-made one, certain factors must be taken into consideration. These factors, in turn, will influence you in making the best option that suits your style, budget, and taste.

With that said, here is a quick overview of the cost breakdown of each option.

|

Building your own home |

Purchasing a ready-made home |

|

|

Land Acquisition Cost |

x |

|

|

Materials Cost |

x |

|

|

Construction Cost |

x |

|

|

Labor Cost |

x |

|

|

Architectural and Engineering Fees |

x |

|

|

Purchase/Contract Price |

x |

|

|

Additional Costs in Constructing a House |

x |

x |

Constructing a house from scratch entails more costs than just purchasing a ready-made house. In constructing a house, you entail costs such as labor and material, architectural and engineering fees, and certain additional costs attributable only to constructing a house. Whereas, in purchasing a ready-made house, the only thing that you can consider is your purchase price.

Now that we have discussed the factors that influence you in deciding whether to purchase a ready-made home or construct one from scratch, let us discuss some closing notes that you can take with you.

- Always consider your costs. Not everyone has unlimited funds to purchase any dreamhouse they want. Thus, the cost of purchasing a ready-made house or constructing it should always be your main consideration before you make your decision.

- Plan your budget. Making a budget is always your main priority. This is to allow you to control your expenses thereby having ample amount of funds to purchase or construct your dream home.

- Always consider the benefits of each option. Choosing between purchasing and constructing your own home can be an overwhelming task. However, this burden can be lessened if you consider the benefits available for each option, such as the place's security, amenities' availability, and the location of your home.

What are you waiting for? PrimaryHomes’ properties are the best investment when compared to building your home from scratch.

If you need any more help or information, contact PrimaryHomes.

.jpg)

-min.jpg)